With flood-ravaged Kerala awaiting more financial aid from the Central government for rehabilitation and rebuilding, its Finance Minister Thomas Isaac wants the Centre to issue an ordinance to change GST laws to permit the state to levy cess for mobilising resources.

“I will write a formal proposal to the GST Council requesting permission to levy cess on the State GST. The existing rules have to be changed for it. I will also seek an appointment with the Union Finance Minister by September 10 to request him to issue an ordinance making the required changes in the law,” Isaac said.

Story continues below this ad

He said he would talk to other state finance ministers for their support. “No one can object to it,” he said. “The council has to meet and agree and the Centre can issue an ordinance.”

The next GST Council meeting is scheduled for the end of next month.

READ | Need Rs 21,000 crore cess, says Finance Minister Thomas Isaac

The amendment Kerala is seeking is to enable the Council to impose a special rate or rates for a specified period to raise additional resources during any “natural calamity or disaster”.

Story continues below this ad

Isaac claimed that allowing the state to levy cess on SGST is the “minimum” the Centre can do and “there is no logic denying the state permission for it as it’s an intra-state tax.”

Meanwhile, sources said pending a formal proposal from the Kerala government, the Finance Ministry has begun informal discussions on the legal feasibility of the cess.

A senior official said that various options were discussed internally including a separate law which could be either Kerala-specific or provide for natural calamities in all states. If not a cess, then the state could also consider a change in tax rate of State GST (SGST).

For instance, the state government could consider a change in tax rate, say, a cumulative 19 per cent GST (9 per cent Central GST (CGST) + 10 per cent SGST) over the current rate of 18 per cent (9 per cent CGST + 9 per cent SGST). The broad categories of tax rates under GST are zero, 5, 12, 18 and 28 per cent.

Story continues below this ad

But experts warn that this could derail the inherent structure of GST since it gives scope for other states to also change their SGST rates and that it would imply moving to the pre-GST era when states had different VAT rates.

“Altering the GST architecture by imposition of a state-specific cess at a time when GST is in a stabilization phase would be inadvisable. This could create a precedent and over time lead to rate differences across states, prevailing in the erstwhile VAT regime,” said M S Mani, Partner, Deloitte India.

Isaac further said that the situation in Kerala is a “perfect example to show that laws have to be more flexible.” He said: “States have no other means to collect resources if there is a situation like this. I have always been arguing that states needs more federal flexibility.”

Earlier, Isaac told The Indian Express that the Kerala government will need at least Rs 21,000 crore to reconstruct basic infrastructure following the unprecedented floods and will look at various options to meet the burden including approaching the GST Council to allow the state to levy a cess.

Story continues below this ad

A step-by-step guide on how you can donate to the Kerala CM’s relief fund

However, if not a cess, the Kerala government will have room to raise the state GST rate up to 20 per cent, as provided in the state’s GST Act. The Kerala SGST Act states: “…there shall be levied a tax called the Kerala State Goods and Services Tax on all intra-State supplies of goods or services or both, except on the supply of alcoholic liquor for human consumption, on the value determined under Section 15 and at such rates, not exceeding twenty per cent, as may be notified by the Government on the recommendations of the Council.”

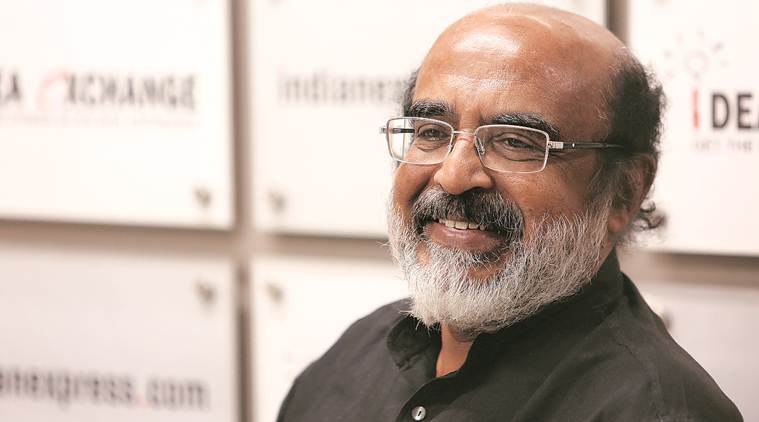

Speaking to The Indian Express, Thomas Isaac said he was busy supervising relief and rehab work in Alappuzha district and would write to the GST Council by September 2. (Express Photo by Gajendra Yadav/File)

Speaking to The Indian Express, Thomas Isaac said he was busy supervising relief and rehab work in Alappuzha district and would write to the GST Council by September 2. (Express Photo by Gajendra Yadav/File)